Greetings. We hope this note finds you safe.

We all know returns in the 1st quarter of this year were brutal. A solid start to the year quickly turned into the worst first quarter in the history of the US Stock Market. Commerce, in general, has ceased. Current job losses are setting all-time records. We have never experienced anything like this in history. Markets are confused. Everyone is.

Over the last 30 days, we’ve taken many questions. Today we would like to try and answer a few that center around:

- “What should I do now?”

- “What are my next steps?”

- “What should I focus on?”

It’s understandable we as investors (and humans) contemplate these questions both out of fear and also out of our newly found resource – TIME. As you have more time over the next 30-60 days, we would ask another question, stated somewhat differently…WHAT CAN WE CONTROL?

While this is not an all-encompassing list, we feel several, if not all of these, are applicable to most of our clients.

Personal: Take care of your family, take care of your personal health, read a book you’ve never had time for, go for a walk/run, etc. We would highly recommend Nick Murray’s “Simple Wealth, Inevitable Wealth”, available here) https://nickmurray.com/product/simple-wealth-inevitable-wealth-20th-anniversary-edition/

Budget: If you haven’t already done so, evaluate your monthly spending. We’re sure this has changed as most of us ‘shelter in place’. There are many online options (Mint.com, Fidelity Full View) but we have several pre-built templates as well. Please reach out if you’d like us to send one your way. And we don’t suggest you work on a budget to limit spending, necessarily. The primary goal is to ensure we track spending. And we always suggest ‘other/misc’ not exceed 10%.

Emergency funds: Whether via cash, a savings account, or via a line of credit, as a budget is established, it is important to know what a 3/6/12 month emergency cushion would look like. The current economic environment is a very un-friendly reminder of how important this task is.

Long-Term Plans: This is a good time to examine life goals, the timeline associated with those goals, dollar amounts required for those goals, and an action plan to accomplish them. We’re here to help. Our goal is to design a clear plan for every client.

IRA to Roth IRA conversion: This may be a lengthy conversation and we will not write all the reasons in this note, but evaluating an IRA to Roth conversion can be a valuable long-term planning tool depending upon your annual income, your timeline to draw on those funds, the size of your IRA’s, tax implications, etc. With the stock market down sharply NOW is a very good time to explore this option. Again, we’re here to help.

Diversification: NO ONE knows how various asset classes will respond based on an ever-changing world. Gold and silver have historically been considered “safe havens”. However, recently, both have fallen 15-20% in one day. Same for REIT’s, Municipal Bonds, etc. This selloff has spared no sectors. And no one has a crystal ball. Staying diversified, by definition, means not having 100% of your money in the best-performing asset class. BUT, it also means not having 100% of your money in the WORST. We cannot emphasize this enough.

Tax-Efficiency: IT’S NOT WHAT YOU MAKE, IT’S WHAT YOU KEEP. Consider wages vs. expenses. If we make another dollar at our job we do not keep that entire dollar (fed taxes, state taxes, county taxes). However, if we save a dollar in expenses by cutting something out, we keep that entire dollar. Investing is similar. Using down markets to effectively manage tax liability can be glimmer of sun on a cloudy day. We make a lot of changes every year for tax reasons – usually in December. Look for those changes a lot sooner this year.

Pay your mortgage: We fully understand if you cannot pay your mortgage because of job/income loss or uncertainty. Right now, if you call your lender, most will give you relief and you can ‘skip’ 3-6 months of mortgage payments. However, we believe mortgage rates will settle down and may drop further as we work thru the crisis. If we’re right and you want to refinance to a lower rate, ‘skipping payments’ now will prevent that refinancing option. If you can afford to keeping paying your mortgage, we highly recommend you do so.

Review the Cares Act: Consider how the act affects you personally. Here is a link for a solid summary.

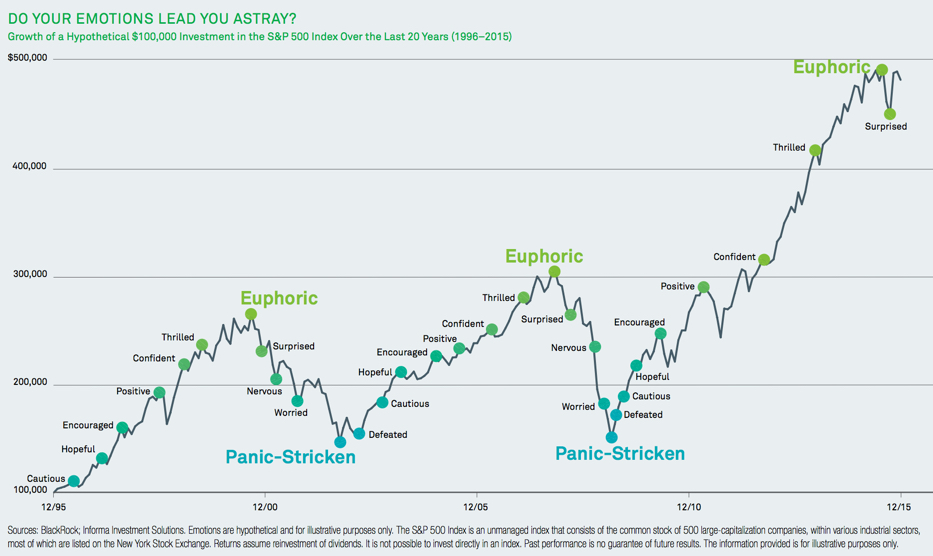

Emotions (see chart below): From Thanksgiving through January we had countless discussions of clients wanting to get more aggressive as the stock market hit all-time highs. Fear of Missing Out (FOMO) is a powerful emotion as greed sets in. When you flip that around 180 degrees, you get extreme fear and the natural desire to sell. THE TIME TO BUY WAS NOT JANUARY…THE TIME TO SELL IS NOT NOW.

“The stock market is the only market where things go on sale and all the customers run out of the store…”

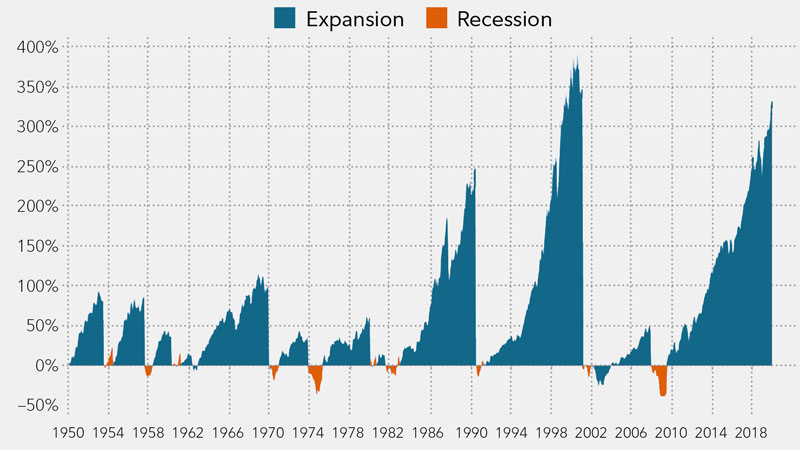

Gains during expansions have far outpaced losses suffered during recessions

Source: Bloomberg. S&P 500 Index total annual return for January 1950 through December 2019. Past performance is no guarantee of future results.

As always, please reach out to our team for anything you need. We are here to help.

Sincerely,

Your LJI Team